Let’s rewind a decade. It’s 2009. Vancouver, Canada.

Stewart Butterfield, known already for his part in building Flickr, a photo-sharing service acquired by Yahoo in 2005, decided to try his hand — again — at building a game. Flickr had been a failed attempt at a game called Game Neverending followed by a big pivot. This time, Butterfield would make it work.

To make his dreams a reality, he joined forces with Flickr’s original chief software architect Cal Henderson, as well as former Flickr employees Eric Costello and Serguei Mourachov, who like himself, had served some time at Yahoo after the acquisition. Together, they would build Tiny Speck, the company behind an artful, non-combat massively multiplayer online game.

Years later, Butterfield would pull off a pivot more massive than his last. Slack, born from the ashes of his fantastical game, would lead a shift toward online productivity tools that fundamentally change the way people work.

Glitch is born

In mid-2009, former TechCrunch reporter-turned-venture-capitalist M.G. Siegler wrote one of the first stories on Butterfield’s mysterious startup plans.

“So what is Tiny Speck all about?” Siegler wrote. “That is still not entirely clear. The word on the street has been that it’s some kind of new social gaming endeavor, but all they’ll say on the site is ‘we are working on something huge and fun and we need help.’”

Maybe I make a terrible boss, but at least I know it. Work with me: http://tinyspeck.com/jobs/cptl/

— Stewart Butterfield (@stewart) July 10, 2009

Siegler would go on to invest in Slack as a general partner at GV, the venture capital arm of Alphabet.

“Clearly this is a creative project,” Siegler added. “It almost sounds like they’re making an animated movie. As awesome as that would be, with people like Henderson on board, you can bet there’s impressive engineering going on to turn this all into a game of some sort (if that is in fact what this is all about).”

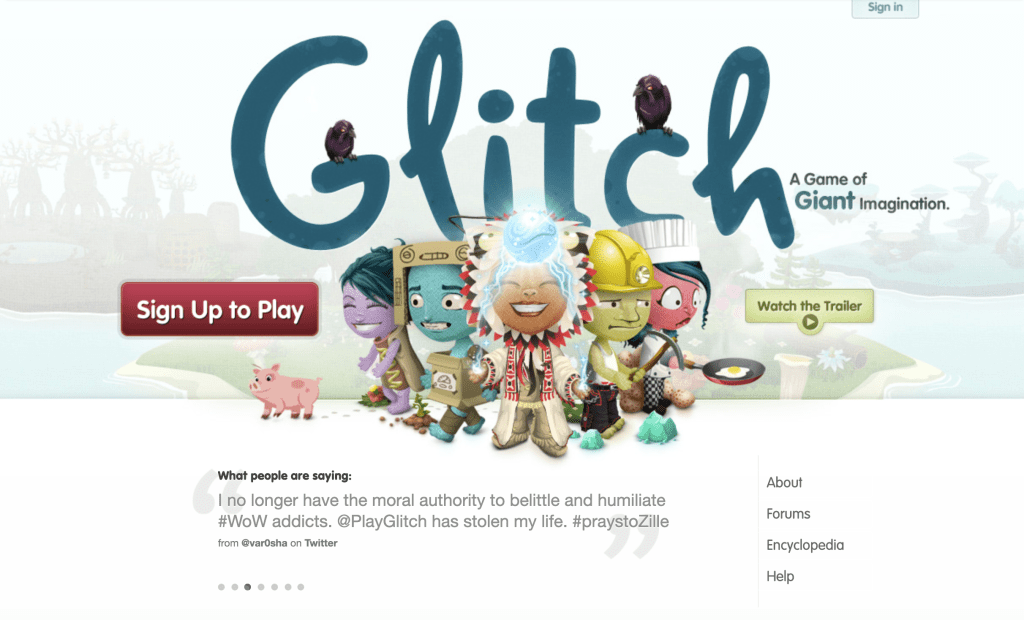

After months of speculation, Tiny Speck unveiled its project: Glitch, an online game set inside the brains of 11 giants. It would be free with in-game purchases available and eventually, a paid subscription for power users.

For months, tech blogs, including TechCrunch, chronicled Tiny Speck’s every move, anxiously awaiting the launch of Butterfield and Co.’s latest undertaking. When it was finally released to the public in September 2011, Butterfield sang its praises and bragged of its authenticity.

“We think it’s beautiful and awesome,” Butterfield told TechCrunch in 2011. “[It’s] what we wanted to build, rather than designing it in a certain way because we think it will monetize better.”

Glitch’s glitch

With the support of more than $15 million in venture capital funding — all before the game began beta testing — Tiny Speck hired more than 40 employees, wrote hundreds of lines of code and concocted big dreams for its zany, whimsical and absurdist universe.

Andrew Braccia of Accel and John O’Farrell of Andreessen Horowitz, established investors belonging to two of the most renowned VC funds in Silicon Valley, were the first to put institutional capital in Butterfield’s obscure project. The pair invested in the game’s seed financing, its $5 million Series A and $10.7 million Series B. In an April 2011 Glitch blog post announcing the Series B, Butterfield wrote that things were going “swimmingly.”

18 months later, Glitch would crumble.

Glitch wasn’t fun. According to various accounts and interviews Butterfield gave at the time, Glitch was too complicated, not fast enough and “handcuffed by Flash,” Adobe software that, if you remember, emerged in the late 90s’ and was bordering on irrelevancy by the time Glitch came out.

“We had spent a lot of money; we had a big team; we had no real avenue to port to mobile, or have a good and powerful mobile component,” Butterfield told gaming blog Gamasutra in late 2012. “If one of those things was different, it would have made sense to keep going. Given the totality of the position we were in, it made no sense.”

Glitch ceased operations with enough money left to offer severance packages to its remaining staffers. And Butterfield told his investors he would give them back any money he had left. That is, unless they were interested in supporting his latest and greatest idea.

A new beginning

When Butterfield confirmed Glitch’s fate on the startup’s blog, he noted that the team had “developed some unique messaging technology with applications outside of the gaming world and [that] a smaller core team [would] be working to develop new products.” Then, he tweeted the following message, a cryptic hint at what was to come. Again, people speculated.

To be clear: Tiny Speck is not closing, just Glitch. There will be more to say about that in the future, but: you will know it well. Well.

— Stewart Butterfield (@stewart) November 15, 2012

TechCrunch’s Ingrid Lunden, in a story covering Glitch’s shut down, predicted Butterfield was constructing another photo-sharing service of sorts. No one, at that time, pictured the enterprise giant Tiny Speck, soon to be known as Slack, would become.

“He could have continued, but he thought given our ambitions and the time and place where we are today, let’s end it now and move on,” Accel’s Andrew Braccia said of Butterfield in a 2015 interview with TechCrunch. “We [discussed] should [Butterfield] return the money but the company we had invested in was Tiny Speck, which produced the game. And the reason we invested in Tiny Speck was because we were investing in that team. I told [Butterfield], ‘If you want to continue to be an entrepreneur and build something, then I’m with you.’”

Butterfield tapped Braccia, a former Yahoo colleague, when he first began looking for capital to build Glitch. Braccia had been a general partner at Accel since 2007, responsible for genre-defining investments in Squarespace, Cloudera and others. His decision to stand by Butterfield during Tiny Speck’s big pivot would pay off — big.

The big pivot

Sometime between late 2012 and early 2013, Butterfield told his investors his gaming startup would pivot to enterprise software. Tiny Speck would henceforth be known as Slack, the provider of a messaging tool for facilitating workplace communication, an “email killer” and the ultimate collaboration app.

Most startups die. Startups that pivot from their original idea are even less likely to beat the odds. One can only imagine how Tiny Speck’s investors reacted to Butterfield’s ambitious transition.

Tiny Speck’s executive team had been based in different cities across North America. Butterfield and Mourachov lived in Vancouver, Henderson had set up camp in San Francisco and Costello managed client development from New York City. To allow for constant, real-time chatter, Tiny Speck’s engineers constructed a messaging tool for internal use. When the team realized Glitch’s inevitable fate, the communication tool, they thought, could have some value outside of their little startup.

“We realized, wow, this is hugely a productive way of working and I think all of us agreed we wouldn’t work without a system like this again and maybe other people would like it,” Butterfield said in a recent video released by Slack ahead of its June 20 direct listing on the New York Stock Exchange.

So the team reimagined their future and looked to their investors for support.

Accel, sources tell TechCrunch, remained committed. Andreessen Horowitz, however, had a more complicated response. According to sources familiar with the matter, a16z was highly skeptical of Butterfield and whether he could succeed in the enterprise space. When Tiny Speck went out to raise its first round of capital as an enterprise software upstart in what would technically be its Series C, a16z hesitated.

“If you want to continue to be an entrepreneur and build something, then I’m with you,” – Accel’s Andrew Braccia told Slack CEO Stewart Butterfield.

A source close to Slack told TechCrunch that a16z put the company “through the ringer,” telling Butterfield that enterprise “wasn’t in his DNA.” A16z denies these accounts citing their close relationship with Butterfield and the business in 2019. Admittedly, it’s unclear how much capital a16z may or may not have funneled to Slack at the Series C but given it currently owns nearly 10 percent less of Slack than Accel, a fellow early investor, its likely to have cut back its capital commitments around the time of Tiny Speck’s pivot.

Ben Horowitz, a co-founder of the storied venture capital firm, has spoken publicly about the doubt he had in Butterfield in those days. In 2015, he told journalist Kara Swisher that initially, he thought the messaging tool sounded “like a really horrible idea.”

“The thing that made me think that [it] was probably not a good idea was Stewart himself,” Howoritz said. “[He is] about the most artistic CEO we had in the portfolio in terms of his whole persona. Every time I saw him it looked like he had been up all night, smoked four packs of cigarettes, you know that kind of personality. So I’m like Stewart, do you really want to run an enterprise software company, that seems like not you? He’s like no, I think this product is good, I think it would work and we are like well, $6 million isn’t going to make any difference to our returns, so sure, continue with it and that tool turned out to be Slack … I couldn’t have gotten it more wrong.”

The firm’s uncertainty was justified, of course. After all, how many gaming industry CEOs pivot, successfully, to enterprise software?

Around this time, another firm, the up-and-coming Social+Capital Partnership, jumped at the chance to get on Slack’s cap table. The fund — managed by early Facebook executive Chamath Palihapitiya and veteran investors Mamoon Hamid and Ted Maidenberg — led Slack’s $42 million Series C. Maidenberg and Hamid are said to have sourced the deal, with the latter joining the company’s board because of his expertise in the space.

When Hamid exited Social Capital in 2017, Palihapitiya assumed the coveted Slack board seat, which he still holds. Despite, a lack of involvement in deal sourcing and subsequent company building, Palihapitiya has received a great deal of credit for Social Capital’s big bet on Slack.

Recently, he took to CNBC to gloat over the company’s success ahead of its direct listing. The statements were not authorized by Slack and because of the quiet period — or an SEC-mandated embargo on promotional publicity ahead of public listings — Slack was forced to file an official document claiming its lack of knowledge of Palihapitiya plans to peacock, so to speak, on national television. The scenario illustrates the distance investors will go to pat themselves on the back, especially if it means public acknowledgment of their role, however small, in building game-changing businesses.

Slack skyrockets

Slack launched to the public at the end of 2013 and almost immediately experienced huge, unprecedented demand for its messaging tool. To help employees work more efficiently, the company began integrating dozens of other apps, like Google Docs, Dropbox and Asana, and rolling out new features that attempted to streamline tasks. Shortly after its launch, it closed its Series C; a few months after that, it began fundraising at a billion-dollar valuation.

Slack became a full-fledged platform redefining the future of work in what felt like the blink of an eye. Less than two years after its pivot and months after its launch, Slack claimed to have 60,000 daily users and 15,000 paid seats. At the time, TechCrunch surmised it would get gobbled up by a larger player in the enterprise SaaS space. Instead, it became that larger player.

The reason for Slack’s swift success is manifold. For one, Silicon Valley heavyweights supported it from the getgo. With backers like a16z on board, Butterfield had a network that would make any entrepreneur envious and that network expedited Slack’s path to mainstream popularity.

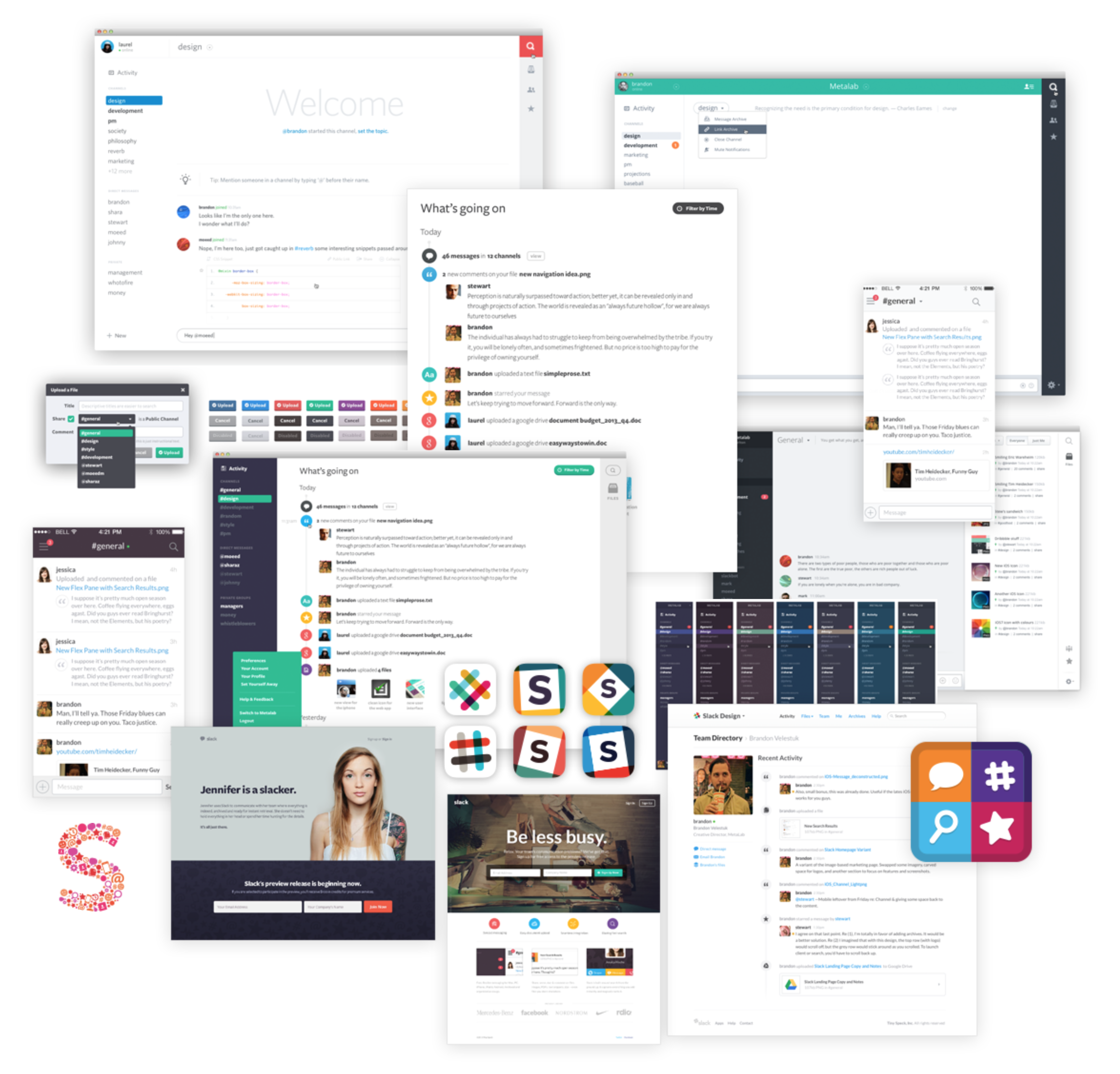

Two, Slack, unlike Glitch, was fun. The MetaLab design team behind the first iteration of Slack said it sought to make the chat app “look like a confetti cannon had gone off,” with bright colors, heavy emoticon usage and a strong personality.

“We gave it the color scheme of a video game, not an enterprise collaboration product,” MetaLab founder Andrew Wilkinson wrote in a 2015 Medium post. “Slack acts like your wise-cracking robot sidekick, instead of the boring enterprise tool it would otherwise be.”

More important to Slack’s victory, however, was timing.

Over the last decade, the percentage of employees working remotely at least one day per week has continued to rise. Slack isn’t intended solely for the remote worker but it’s a tool that’s facilitated remote work across the globe. Whether Butterfield sensed this shift in the way we work or not, he built one of the first tools tailored for the modern-day workforce: A mix of remote and non-remote employees working toward a common goal.

On top of that, Slack adopted a subscription business model as venture capital investment in software-as-a-service (SaaS) took off. In 2010, a total of $5.7 billion was invested in U.S. SaaS startups. By 2014, that figure had more than tripled to roughly $20 billion, according to PitchBook. In 2018, a record $26.4 billion in VC was deployed to SaaS companies.

Slack today counts more than 10 million daily active users across more than 600,000 organizations — 88,000 on the paid plan and 550,000 on the free plan.

“Since our public launch in 2014, it has become apparent that organizations worldwide have similar needs, and are now finding the solution with Slack,” the company wrote in its S-1 filing. “It’s been called an operating system for teams, a hub for collaboration, a connective tissue across the organization, and much else. Fundamentally, it is a new layer of the business technology stack in a category that is still being defined.”

Slack isn’t yet profitable but it’s on its way. The company reported a net loss of $138.9 million and revenue of $400.6 million in the fiscal year ending January 31, 2019. That’s compared to a loss of $140.1 million on revenue of $220.5 million for the year prior. In the first quarter of 2019, the company posted revenues of about $134 million, up 66 percent from $81 million in the first quarter of 2018. Losses from operations increased from $26 million in Q1 2018 to roughly $39 million this year as the company continues to invest in its own growth.

Slack (NYSE: WORK)

To hunt future unicorns, venture capitalists often rely on pattern recognition, referencing history to aptly predict which founders and what startup ideas will produce billion-dollar exits. In the case of Stewart Butterfield, Tiny Speck and Slack, investors looked at Flickr and trusted Butterfield could pull off yet another wild pivot.

Today, Slack is valued at more than $7 billion, making it one of the most valuable venture-backed businesses in the U.S. It’s mere weeks away from its debut on The New York Stock Exchange, where it will begin trading under the ticker symbol “WORK” on June 20. In total, it’s raised a monstrous $1.22 billion in equity funding from backers like Accel, a16z, Social Capital, SoftBank, T. Rowe Price, IVP, Kleiner Perkins and many others.

Accel owns a 24 percent stake worth roughly $1.8 billion. A16z owns a smaller 13.3 percent stake and Social Capital owns a 10.2 percent stake, according to the company’s S-1.

Slack is pursuing a direct listing, an alternative approach to the public markets that allows companies to skip Wall Street’s exorbitant fees and begin trading without selling any new shares. The level of demand for Slack’s stock (NYSE: WORK) at its $7 billion-plus valuation coupled with its unconventional route to the markets will tell us a lot more about Wall Street’s appetite for highly-priced unicorns, which appears to have wavered as big-names like Uber and Lyft gallop into public company-hood.

Spotify, the music streaming giant that chose to pursue a direct listing in 2018, exited without volatility. The company’s stock is trading up ever so slightly, bypassing the unfortunate fates cast upon Uber and Lyft, who’s IPOs did not go off without a hitch. Perhaps investors will be drawn to Slack because of its enterprise SaaS status, a sector known for safe, quality growth. Or perhaps a direct listing, which works best for companies with global brand recognition, has set Slack up to fail.

One thing is certain: Butterfield pulled off a pivot worthy of entrepreneur textbooks.

Comment